Why Choose Saint Lucia Corporate Banking?

If you need to make international payments quickly and seamlessly while benefiting from high financial confidentiality standards, Saint Lucia is an excellent choice. Benefit from competitive rates and convenient 24/7 access to a corporate account that you can open without leaving home. Let’s look at the key advantages that non-residents typically appreciate.

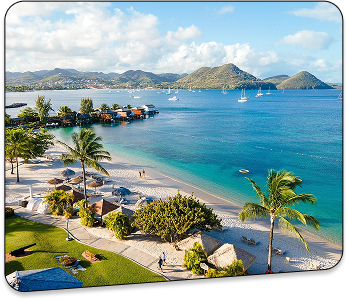

You can save the time and cost of traveling to a faraway destination just to open an account (though of course, this isn’t to say Saint Lucia isn’t worth visiting).

Saint Lucia’s banking secrecy laws provide robust protection for your personal and financial information.

Use the SWIFT system to make secure, efficient, international payments within 24 hours.

Open an account for your company with a minimum deposit of just $5,000.

The bank we have handpicked for our customers offers all the services you need to ensure ongoing business operations without delays. A Saint Lucia bank account comes with impressive benefits.

Setup

Stay where you are and get a fully functional financial instrument in two months.

Debit Cards

You can obtain visa cards at competitive fees to make international transactions even easier.

Stability

The bank is part of the East Caribbean Financial Holding Company, which has a strong regional presence.

Support

Although the main language of communication is English, you can receive support in German, Portuguese, French, or Spanish.

Skip the paperwork and let our team manage everything from start to finish. Your corporate account can be fully operational within two months—no travel required. The bank will handle all compliance checks remotely and issue approval through a secure, streamlined process.

Opening a corporate account remotely in Saint Lucia is a streamlined process when handled by professionals. Here’s how it works:

Step 1

Contact UsDiscuss your situation with our offshore banking experts.

Step 2

Pay the Service FeeThe fee is $3,750 to start the process.

Step 3

Prepare and Submit DocumentsGather the required documents and submit them.

Step 4

Undergo Due DiligenceComplete the bank’s due diligence procedures.

Step 5

Wait for ApprovalOnce approved, make an initial deposit of $5,000.

Step 6

Account ActivationYour account will be activated, and you will receive your online banking credentials.

- Certified copy of the Certificate of Incorporation

- Certified copy of the Certificate of Good Standing/Incumbency (if the company is 1 year or older)

- Certified copy of the Memorandum and Articles of Incorporation (or Articles of Incorporation and Bylaws)

- Certified copy of the Register of Shareholders

- Certified copy of the Register of Directors

- Certified copy of passport

- Certified copy of driver’s license/permit or national ID

- Proof of address (utility bill under 3 months old or certified driver’s license)

- Reference letter from a banker, chartered accountant, or lawyer (reference letters should not be more than 3 months old, and the client must have maintained a relationship with the issuer for at least 2 years).

For all UBOs (owning ≥ 10%), shareholders, directors, and authorized signatories:

Note: Make sure all the documents are notarized and translated into English if necessary.

Clarify the list of required documents, learn about all the nuances of the process, timelines, and costs from the professionals of the portal.

Uliana Siva

Consultant for company registration, bank account opening, residency, and citizenship.

years of experience

successful cases

We value every client, cherish our reputation and strive for long-term co-operation. Our clients are business people, investors, expats, digital nomads and others. We pride ourselves on the fact that our service meets high standards.

Years of experience

Clients worldwide

Successful projects

Cases

We don’t offer one-size-fits-all templates — only tailored solutions where every detail is carefully designed to meet your specific needs, business interests, and long-term goals.

For over 15 years, we’ve been crafting effective strategies for international businesses and providing comprehensive support.

We agree on the project costs upfront — you will not experience any hidden fees or unexpected charges.

We make sure that you are in capable, trustworthy hands. We fully comply with legal requirements and deliver on every agreed-upon objective.

Your privacy is our top priority. We never share documents, information, or personal data with third parties.

We offer experience, not promises. Our track record of successful case studies and thousands of satisfied clients demonstrates our competence and trustworthiness.

We value the trust of our clients.

Feedback is the best confirmation of the quality of our services and professionalism. This is confirmed by the reviews on Trustpilot.

Google

Google4.86 (21 Reviews)

Trustpilot

Trustpilot4.80 (71 Reviews)

Frequently Asked Questions

- Transfer funds anywhere in the world.

- Check transaction history and account balance.

- Use a TOKEN security device for safe account access.

- Communicate securely using encrypted messaging.

- Maintain a guaranteed deposit of 125% of the credit limit.

- Specify the desired credit limit and choose Visa or MasterCard.

- Pay an annual maintenance fee ($150 or more).

- Multicurrency deposit accounts are available in 15 different currencies.

- Competitive terms with international SWIFT payment processing within 24 hours.

- Confidential and secure online banking access 24/7.

- High level of confidentiality for offshore businesses.

- Assistance with financial structuring, escrow services, and international payroll management.

Our Offers

Your Business

We provide services to private individuals, HNWIs, and companies.

.png)

+1 888 650 0020

+1 888 650 0020

info@internationalwealth.info

info@internationalwealth.info

PH Park Studios, C. La Colina, Panama

PH Park Studios, C. La Colina, Panama